The new school year is in full swing, and soon Year 13 students will be coming home eager to discuss their university applications and supporting statements. While it’s easy to get wrapped up in exploring options, attending open days, and worrying about predicted grades, don’t overlook the crucial step of figuring out how to finance their education! Student finance has changed recently, so don’t assume you know what to expect, even if you’ve navigated the process with older siblings.

This article will help you navigate the key areas to ensure a smooth and worry-free transition to the next stage of life for you, and your child.

How do you plan for student fees?

Forget spreadsheets estimating the total cost of university, this will only reduce you to tears! Just concentrate on the loans and assistance available to you. This will help you to understand the process of university funding more thoroughly. Also, I recommend mentally renaming student loans to student tax, as what your child will borrow and what they may repay can be quite different sums. More details on this later!

Let’s look at the basics

The university funding ‘package’ is made up of two parts:

- Tuition fee loans

- Maintenance support

Since 2017 tuition fees for most university courses have been capped at £9,250 per year (£9000 in Wales). However, many universities have called for this figure to increase so they could rise in the coming years.

Tuition is just one of the costs. Living expenses such as accommodation, food, and support for your little darling must also be figured into the overall cost.

Although most courses are 3 years long, some stretch out for many more years, and that’s not just medicine and dentistry! If you have a budding architect in the family you could be looking at about 6- 7 years of tuition fees and living expenses.

Broadly speaking your child should be eligible for both Tuition fee loans and maintenance support as long as they are studying an approved course at a registered university and haven’t previously started a degree or similar course. Maintenance support is means-tested, so figures may vary (See below for more details).

They’ll also need to be a UK citizen (or have ‘settled’ status) and have lived in the UK for at least 3 years before the course start date.

EU students can apply for the tuition fee loan but won’t usually qualify for assistance towards living costs. Rules and amounts also vary; if you’re a part-time student, over 60, or claiming special circumstances such as refugee status.

Tuition fee loans

Those lucky enough to live in Scotland or Northern Ireland may not have to pay a tuition fee if their child studies in their home country. With such great universities in both, it does beg the question of why go elsewhere. The rest of us need to find up to £9,250 pa. Tuition fee loans cover the full cost of the course and are paid directly to the course provider.

Maintenance support

Great, tuition is sorted! However, our students also have living expenses, and this is where many parents are often confused and misunderstood.

The average student spends £1104/month on accommodation, rent, food, transport, textbooks, plus anything else you deem essential. This will be more if they are planning to study in London. Do bear in mind local variations in costs occur.

Student living costs in the UK 2024 – Save the Student

What is a maintenance loan?

Your child can apply for a maintenance loan payable directly to them, so they need to learn to budget carefully. When it’s gone, it’s gone! It’s paid each term in England and monthly in Scotland.

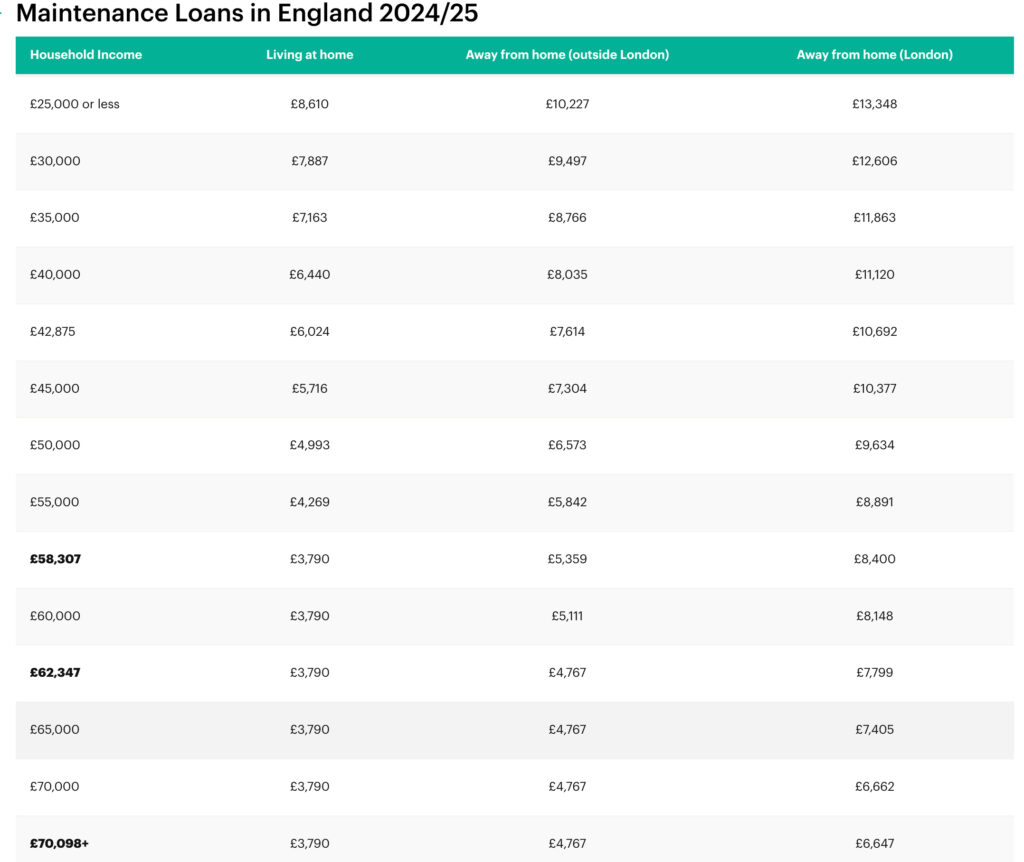

For 2024/25 starters, the full loan is £8,610 if living at home, £10,227 if living away from home, £13,348 away from home in London.

Your household income will determine the maintenance loan figure your child will receive. If you are divorced or widowed then the household income will include your new partner or spouse if you live together with your child. For more examples of whose income is taken into account click here >

As you can see from the table below, once this exceeds £62,347, the maximum loan is £4,767 pa when away from home but outside of London. This loan is added to the tuition loan and repaid in the same manner as noted above.

The table shows the maximum figure you could apply for. However, you aren’t guaranteed to get this! We recommend you apply early so a ‘plan b’ can be put in place if unsuccessful.

Source: www.savethestudent.org

What if you are from Scotland, Northern Ireland or Wales

Scotland & Northern Ireland: Students get a mix of a loan & grant. The higher the family income, then the more is a loan. Parental contribution is still needed.

Scotland

The maximum financial support is £9,000.

Northern Ireland

The maximum financial support depends on where you live.

– If you live at home, you’ll get a maximum of £6,610

– If you live away from home, but outside of London, you’ll get a maximum of £8,136.

– If you live away from home, but in London, you’ll get a maximum of £10,852.

Wales

Parents in Wales are fortunate as no parental contribution is required or expected. Here family income dictates what proportion of the fixed funds received for living costs is a loan and what is a non-repayable grant but everyone gets the same total amount of support.

Divorced Parents: Are Both Parents’ Income Still Considered?

The simple and relieving answer is no. Your child will generally choose the parent they live with most of the time. If they split their time equally between both parents, they can select one parent, typically opting for the one with the lower income. This choice often maximises the maintenance loan available, reducing the need for additional parental contributions to cover living costs.

Finally, How are these loans repaid?

This depends on when you started your course.

Course Started

Repayment

Maximum Term

Interest

How likely are you to repay in full?

Started course in 2022

9% above £22,295

30 years (from the April following graduation)

RPI + up to 3%

23% are likely to repay in full (The state pays 44p in the £1)

Started course in 2023

9% above £25,000

40 years (from the April following graduation)

Just RPI

52% are likely to repay in full (The state pays 19p in the £1)

As an employee, your ‘income’ will be used to calculate how much you will repay. It isn’t the amount that hits your bank each month. They use the full ‘gross’ income meaning, before tax, national insurance, and any pension contributions are taken out.

N.B. As a rule, if you took out your student loan before September 2012 then your interest rate is lower. If you aren’t sure which loan type (1 or 2) you have, I suggest you go to this government page to see the definition of each plan.

If finding the money for university fees means drawing down from your personal pension, redirecting private school fees or ‘just’ finding the extra from your income, with careful planning and prudent advanced saving, university fees can be managed.

Do bursaries and hardships funds still exist?

The short answer is yes! However, bursaries are such complex areas that I could write a whole new article about them.

Universities and colleges may offer bursaries and hardship funds to support students who face financial difficulties during their studies. Bursaries are typically awarded based on various factors, including household income and academic achievement. Hardship funds, on the other hand, are emergency funds designed to help students who experience unexpected financial hardships during their course.

– Student grants and bursaries

What about students with a disability?

In higher education, the definition of disability covers a broader range of challenges than you might expect. It includes physical disabilities, medical conditions, sensory impairments, mental health conditions, and specific learning difficulties, such as dyslexia, that impact a student’s ability to study.

If this applies to your child, you can apply for Disabled Students’ Allowances (DSA) in addition to regular student finance. This extra support is intended to cover costs associated with any additional assistance needed to ensure equal opportunities for studying at university. The level of financial support is determined by assessed needs rather than parental income, and unlike other forms of student finance, it does not have to be repaid. We recommend applying before finalising your choices.

However, if you haven’t applied yet, there’s still time, as the application process typically takes around 14 weeks.

Full details and a guide to how to apply are on this helpful link Disabled Students’ Allowances (DSA) guide 2023 – Save the Student

and finally….

There are some excellent blogs out there. The money-saving expert has one on the truth about uni loans, fees and grants, and I also found an interesting article on ‘9 weird university bursaries grants and scholarships’ on SavetheStudent which is definitely worth a read, where students can be eligible for grants if they are a vegetarian through to your surname being “Graham”!

However you choose to fund your child’s university fees, be sure to plan ahead, seek advice, and consider the long-term impact. Avoid burying your head in the sand or relying on potential political changes to fix the problem.

How will you fund your child’s university fees? Let us know by adding a comment below.

Editor’s note: This post was originally published in June 2023 and has been completely revamped and updated for accuracy and comprehensiveness in October 2024.

References

Thanks Kirsty for the very clear explanation. We’ll be applying for a student loan for our daughter to attend university in the autumn of next year.

Glad to hear it, Nick! Good luck at university to your daughter.