Are you a medical professional owed an overpaid tax rebate? Any doctor, dentist or medic affected by the McCloud Remedy may have potentially overpaid annual allowance and lifetime allowance charges. Over 1 million members of the NHS pension scheme will be affected by the Mcloud Remedy. It’s not often I praise the HMRC, but this is one of those rare occasions. The HMRC have launched a calculator to calculate incorrect tax charges if you were affected by the McCloud Remedy.

Could you be affected by the McCloud Remedy?

The McCloud Remedy will affect anyone with NHS pension scheme service on or before 31st March 2012. This includes those who had left within 5 years of that date who were eligible to rejoin the pension scheme, those who have retired including ill health retirees and spouses/dependents in receipt of a pension.

You may feel this task is too vast and not know where to start. As discussed in recent articles we are here to offer guidance and help. However, some of you may find this straightforward enough so you won’t need to engage a specialist for assistance. Below in 4 simple steps, we explain how to use the new HMRC calculator.

HMRC Annual Allowance/Lifetime Allowance Calculator

Step 1

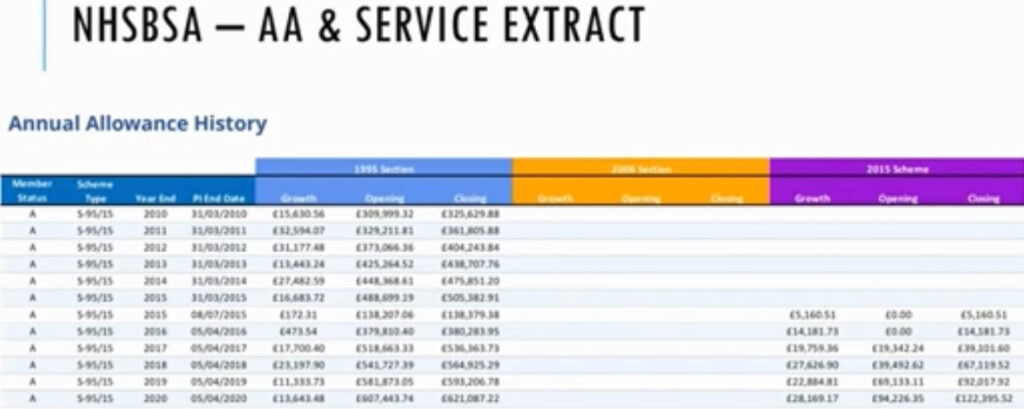

Gather all necessary information including your pension saving statements, annual allowance and service extracts, and tax returns from 2010/11 onwards. To request your annual allowance and service and pay extract spreadsheet call NHS Pensions on 0300 3301346.

Step 2

Check the accuracy of this data, for instance, does your service extract reflect your service accurately? Approximately 1:8 of these have errors, so check carefully, and if you find errors act immediately to correct them.

If you find missing employment in the last 7 years, complete the NHS pension scheme form SM27B and send it to the relevant employer. If it was more than 7 years ago, complete the SM27C form.

A page showing further information and links to both forms is below. This may take some time to correct so start this process of checking and correcting asap.

What should I do if there’s a missing or incorrect membership on my NHS Pension record? >

Step 3

Await revised remedy period pension saving statements showing previous and revised growth, plus your 2022/23 annual allowance statements that will also be issued for remedy members only by 6th October 2024.

Step 4

Go to the HMRC calculator >

The calculator will re-examine the annual allowance and lifetime allowance charges you were liable for due to the McCloud remedy. It has been rigorously tested and after some initial glitches, it is now accurate and reliable.

If all of this feels outside your area of expertise or is too daunting, please don’t hesitate to contact your accountant or Legal & Medical Adviser to seek help.

This article is not specific advice.