On 31 March 2022, the 2019/2020 annual allowance tax-liability compensation initiative closes. Please read this in conjunction with our more recent article: Why October 2024 is so important for annual allowance >

As you are probably aware, various NHS bodies in the United Kingdom have recognised the extra hours doctors have been working to combat and treat the effects of the Global Pandemic. Due to the stealthy nature in which annual allowance tax liabilities are calculated, this extra work could cause doctors significant annual allowance tax liabilities in some cases greater than 100% marginal tax for the extra work.

These various NHS bodies have agreed to a compensation scheme. The compensation will be in the form of making a payment each month equal to the amount of the members’ pension reduction if they use NHS Pension Scheme Pays to meet any annual allowance tax liability for the 2019/2020 tax year. They will also compensate for any lump sum reduction, meaning the compensation becomes payable when the member takes their NHS pension benefits and will be a separate payment to the actual NHS pension benefits.

Any doctor who uses the NHS Pension Scheme Pays to meet an annual allowance tax liability for the 2019/2020 tax year should not see a reduction in their NHS pension scheme benefits for the 2019/2020 tax year only.

To coin the phrase ‘a bit of a no brainer’, for NHS clinicians, who are members of the NHS pension scheme, the use of NHS Pension Scheme Pays now becomes the favoured option in the case of compensation.

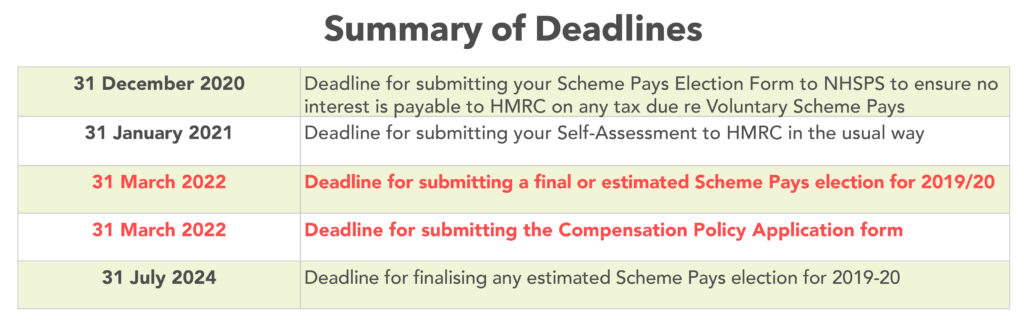

There is, however, an application process that needs following and deadlines to be met.

- You should have already notified HMRC of any annual allowance liability for 2019/2020 by 31 January 2021. If you haven’t, HMRC can fine and charge interest for late notification. Although fines are rare and you could appeal. However, there are no guarantees HMRC will waive late payment penalties.

- You will need to complete the NHS pension annual allowance Scheme Pays Application and send it to the NHS pensions agency. Originally, the deadline for scheme pays applications was 31 July 2021. However, the deadline has been extended to 31 March 2022. So, there is still time if you are quick!

- A compensation application will also need to be completed and sent with the NHS Annual Allowance Scheme Pays application. Part of the compensation letter should be completed by your employer/trust.

A bit of a process! But well worth the effort to claim the compensation if you have an annual allowance liability for 2019/2020.

There are two types of Scheme Pays; Mandatory Scheme Pays and Voluntary Scheme Pays.

Mandatory Scheme Pays: This has to be offered by all UK registered pension schemes if a member exceeds the standard annual allowance of £40,000 after taking into account Carry Forward.

Voluntary Scheme Pays: This is offered voluntarily by the scheme if a member has an annual allowance tax liability as a result of a reduced annual allowance such as a Tapered Annual Allowance (or Money Purchase Annual Allowance).

Fortunately, the NHS pensions scheme has decided to offer both Mandatory and Voluntary Scheme Pays options to its members, with some limitations on the scheme pays for the tax year 2016/2017.

HMRC deadlines and NHS Scheme Pays deadlines

There are deadlines for notifying HMRC of any annual allowance liabilities and also deadlines for NHS Pension Scheme Pays applications.

These deadlines are:

- You should notify HMRC of any annual allowance liability by 31 January following the year the liability has arisen (a tax liability for the tax year 2020/2021 should be indicated on your self-assessment tax return by 31 January 2022). As mentioned before, the HMRC can fine and charge interest for late notification, although fines are rare and you could appeal any charge or fine. There are, however, no guarantees HMRC will waive late payment penalties. You should also indicate on your self-assessment if you are using scheme pays to meet the liability by 31 January.

- If you are paying the annual allowance tax liability from your own savings/capital this will need to be paid by 31 January following the year the liability has arisen as with the notification process above.

- You will need to complete the NHS Pension Annual Allowance Scheme Pays application by 31 July following the year the annual allowance tax liability has arisen (eg. for the tax year 2020/2021 liabilities, the NHS scheme pays deadline is 31 July 2022).

N.B. The NHS pension scheme pays deadline has been extended for 2019/2020 as covered under the compensation section above.

When completing the NHS pension scheme pays application, we always suggest you indicate that the amount stated is an estimate. You can change the scheme pays amounts up to 4 years after the application is accepted. This will avoid any potential problems with HMRC regarding late notifications.

Will the recent McCloud case have any effect on annual allowance and scheme pays?

It looks like as a result of the recent McCloud consultation qualifying members of the NHS pension scheme will revert to their respective legacy NHS pension scheme (95 section or 2008 section) for the remedy period (01 April 2015 – 31 March 2022). Due to the different accrual rates between the 2015 sections of the NHS pension scheme and the legacy schemes, any annual allowance input/growth will alter for the years affected covered by the remedy period. For many members, this could see a reduction in annual allowance liabilities.

As a result of moving back to the legacy pension schemes you do see a reduction in your annual allowance liabilities for the years affected, you will be able to claim a refund of overpaid tax from HMRC.

If you have overpaid tax from your own savings/capital you should get this back. If you have used scheme pays, either NHS or another provider, the scheme will claim overpaid tax from HMRC once notified by you.

This is why you should always indicate that any annual allowance tax liability on the scheme pays application is an estimated amount as this will allow you to make any necessary alterations. It also seems that the 4-year rule to make alterations will be waived if the overpayment is a result of the McCloud case age discrimination.

Do you have any questions regarding tax liability compensation? Let us know by adding a comment below.