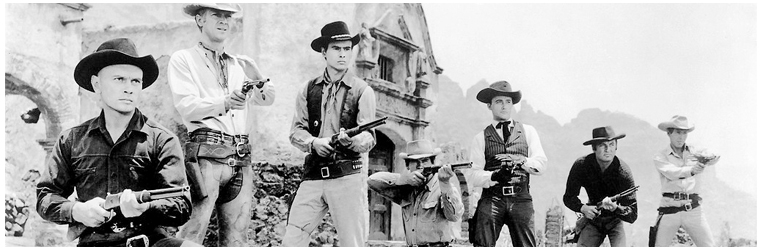

The Magnificent Seven, the old western film evokes memories of seven Hollywood greats who saved the day for the downtrodden. But what does an old 60s movie have to do with the stock markets? Well, the film’s strapline was “They fought like 7 hundred’ and this is entirely appropriate when we consider the recently-dubbed-in-their-honour Magnificent 7 company stocks trading on the US stock market. Or if you’re down with the investment kids and know the lingo, The Mag 7.

Who are these US behemoths?

The Mag 7 comprises Microsoft, Apple, Nvidia, Alphabet (Google), Meta, Amazon and Tesla. Whilst not ‘fighting’ like seven hundred, certainly are now so large that they have a market capitalisation of 700 – or more like 7,000 ‘normal’ sized companies!

The market capitalisation (i.e. the value of these companies as calculated by number of shares in issue multiplied by the share price) is as follows:

| Company | Market Capitalisation USD* | Ranking by size on the US stock market (S&P 500) |

|---|---|---|

| Microsoft | $3.29 Trillion | 1st |

| Apple | $3.26 Trillion | 2nd |

| Nvidia | $3.24 Trillion | 3rd |

| Alphabet (Google) | $2.19 Trillion | 4th |

| Amazon | $1.91 Trillion | 5th |

| Meta | $1.28 Trillion | 6th |

| Tesla | $0.57 Trillion | 12th |

| Mag 7 Total | $15.74 Trillion |

*Yahoo Finance as of 14th June 2024

$15.74 Trillion is the current value of these Mag 7 stocks, and 6 of them are the largest companies on the S&P 500

To put that into perspective, let’s compare that to a couple of wider well-known stock markets in terms of size & valuations:

| Stock Market | Market Capitalisation USD* | %comparison |

|---|---|---|

| US S&P 500 | $47.37 Trillion | The Mag 7 make up 33% of the S&P 500 |

| UK FTSE All-Share | $3.1 Trillion | The Mag 7 are more than 5 times the size of the entire UK stockmarket |

*Bloomberg 14th June 2024

You get the picture: the Mag 7 are huge. As well as making up almost a third of the S&P 500 by value, at current valuations any one of Microsoft, Apple & Nvidia is larger than the combined value of the entire UK stock market. The growth of some of these Mag 7 stocks has been exponential, as they are all – to a greater or lesser degree – driven by the growth we have seen in recent years in technology & AI.

Are these valuations realistic?

In the absence of a crystal ball – or indeed HG Wells’ Time Machine as your preferred mode of transport, in lieu of a Tesla, this is a very difficult question to answer. These stocks may have a good deal further to grow but – equally – some may view valuations as being on the high side.

An often-used measure of how ‘fair’ a company is valued is its Price/Earnings Ratio – or P/E ratio for short. This is the ratio of a company’s share price to the company’s earnings per share. The ratio is used as a fairly simplistic ‘at a glance’ measure for valuing companies and to indicate whether they may be overvalued or undervalued.

However, it has to be said that ‘growth’ companies (such as in the technology sector) tend to have much higher P/E ratios than ‘value’ companies (such as more defensive shares like utilities, banks & consumer goods).

The former tend to reinvest revenue to fuel more growth, whereas the latter tend to have lower P/E ratios as they are more established and typically pay more of their profits out as dividends.

The current forward P/E ratio of the S&P500 is around 23 x earnings, and for the UK’s FTSE All-Share, it stands just over 18 x earnings. By comparison, the Mag 7 P/E ratios are as follows:

| Company | Price/Earnings Ration* |

|---|---|

| Microsoft | 38 x earnings |

| Apple | 36 x earnings |

| Nvidia | 77 x earnings |

| Alphabet (Google) | 27 x earnings |

| Amazon | 51 x earnings |

| Meta | 29 x earnings |

| Tesla | 45 x earnings |

| Mag 7 Average | 43 x earnings |

*Yahoo Finance as of 14th June 2024

OK, so using this fairly blunt tool as a measuring stick, one could make the argument that most of the Mag 7 stocks are trading at pretty high valuations. Equally, we are in unchartered territory, as who knows where we could be 5 or 10 years hence? In driverless cars? Having purchases delivered within minutes by drone? Just thinking you want something to happen – and hey presto – it does?

Our discretionary portfolios

Do we currently invest in the Mag 7? Yes of course to a degree. One always needs to have an eye on long-term growth. We cannot afford for our clients not to have some exposure here.

Are we overexposed? No. In fact, in tandem with our Discretionary Investment Manager partnership with Copia, we are actually underweight. All our portfolios have some exposure to the Mag 7. But all are below market weighting, with exposure increasing with greater risk.

Concentration or Diversification? Our current view, whilst fairly positive on global shares as a whole – is to err on the cautious side concerning US and Mag 7 exposure. We are currently diversified across all Global markets. We have heavier weightings in other parts of the globe to compensate for the underweight position in the US.

This will help us manage risk and volatility for our wealth management clients, who enjoy the benefits of our Discretionary Model Portfolios. Please speak to your adviser if you are not yet taking advantage of this proactive investment strategy.

And lastly…

It’s a good pub quiz question to ask you to name all the original magnificent seven cast, and which of the 7 were still standing in the movie?

The survivors were…. Actually, I don’t want to chuck in spoilers just in case you’ve never seen it. And if you haven’t please do – it’s well worth it for the movie soundtrack alone.

This article should not be interpreted as specific advice, as always we would urge you to contact one of our specialist advisers who will look at your own circumstances before advising.