Knowing your financial incomings and outgoings is essential for budgeting. This may seem like the simplest of tasks, but you’ll be surprised how many doctors and dentists look at me sheepishly when I ask them to run me through their outgoings.

Some clients can recite their direct debits with the accuracy of a well-schooled 10-year-old, however, the polar opposite is pretty common. Yes, I know it feels like a dull way to spend your time but believe me this simple task will bring you far greater benefits than you may imagine.

To help you budget, Legal & Medical now offers all clients a free and confidential way of letting our secure online portal do most of this work for you. More on this later.

There are many reasons why it is important to budget and know exactly where you are spending your money.

Knowing how to budget will help to…

1. Reduce financial stress

Let’s start with the biggest! Not knowing where all your money goes each month can mean you are either hesitant to spend money or save it for fear of running out. So, getting to grips with what money hits your bank account each month in terms of salary and what you spend it on will empower other decisions in your life.

2. Stop careless spending or overspending

Budgeting is the easiest way to maintain spending on the things you love so you can eliminate the less enjoyable. Bad spending habits hate nothing more than being exposed to scrutiny! For example: if you look at your outgoings and see a surprising amount going out each month to ‘Mr Starbucks’ and each time you think ‘it’s only a coffee’ you may need to change your mindset! Instead, think of spending that £30-40 per month on something more meaningful. It’s the little drip-feed expenditures that often add up and surprise us the most.

Try quantifying good spends in terms of coffees or a round of drinks; for instance, putting off taking-out income protection could equate to cutting down on X flat whites or x pints and a glass of wine.

3. Find some excess money allowing you to save

Once you know you have some excess money your thoughts can turn to that ‘thing’ you wish you had that costs a little more. This can become your first savings goal. Don’t let the fear of running out of money before the next payday stop you from achieving your goals. It’s all about deferred gratification and giving up something now for something greater later.

Trust me, it’s all the sweeter when you have made a plan, carried it out and achieved your savings goal.

4. Minimise your debt

The flip coin of saving is debt. While some debt is ‘good’ (mortgages/practice loans to buy), debt simply because you unwittingly spent more than you earn is not good. Living beyond your means can quickly become an expensive stressful habit, especially with interest rates currently so high. By budgeting, you will minimise the chance of creating debt – just by being aware of how much you can spend after covering your fixed costs like rent/mortgage, bills, food and fuel.

5. Save to create an emergency fund

Try to create an emergency fund for those unforeseen expenses that life brings and use it to fix a boiler, change your car, or pay for something without reaching for an expensive credit card.

It’s worth spending some time

It’s hard to earn money, so I really urge you to set aside a little time to see how you spend your hard earned salary. Even if you rarely run out of money each month and can spend whatever you like, or you are constantly bouncing in and out of your overdraft, the same principles apply.

We all have increasing sums haemorrhaging from our accounts so let’s get organised and see if we can make more money available for the important things in life! Maybe even reduce the number of nights we spend lying awake at night worrying about it.

Our Client Portal

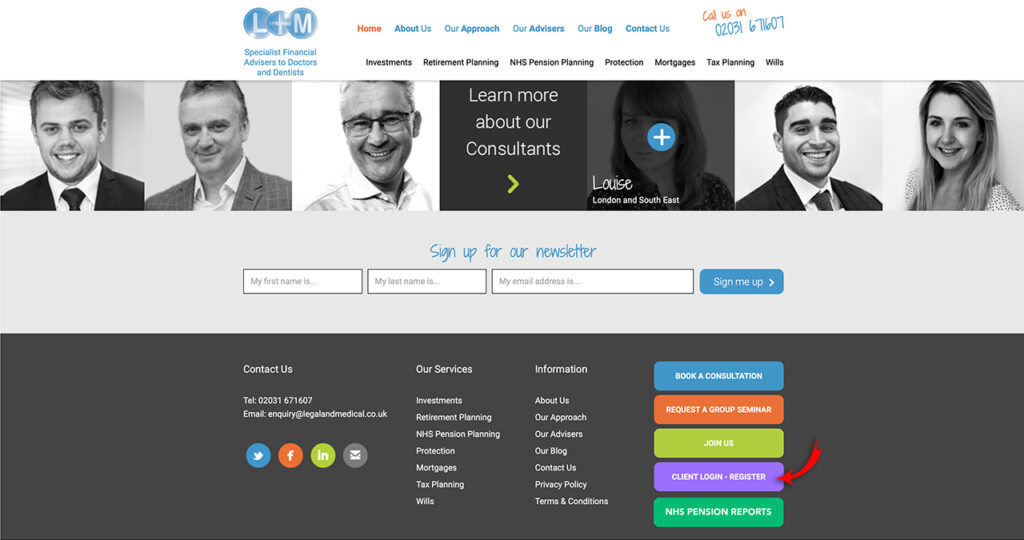

All our clients have free access to our secure online portal where you can see your current investments, pensions and protection policies. We have now added an extra function where you can link your bank accounts and start budgeting without needing to manually make a note.

Our ‘Client Login – Register’ button can be found on our website in the footer area, as per the image below.

Just so you are aware – the banking area is a private function within the portal that we cannot see. It’s a free and totally confidential way of getting your monthly expenditure under control.

If you are already registered on our portal you can start straight away. If you aren’t, please get in touch with your adviser, who will be more than happy to send you the registration to get you started.

Have you checked your incomings and outgoings recently? Let us know by leaving a comment below.