Legal & Medical, along with other top NHS Specialist IFA’s and Accountancy firms were recently invited to an audience with NHS pension scheme stakeholders to clarify what was happening regarding NHS pension updates in several key areas.

The NHSPS continues to evolve, and the devil is, as the saying goes, in the detail. Although the meeting covered a lot of ground the notable information afterwards doesn’t neatly fit into any one box! So, please forgive the seemingly randomness of the topics discussed in the points below.

1. Scheme pays compensation policy 2019/2020

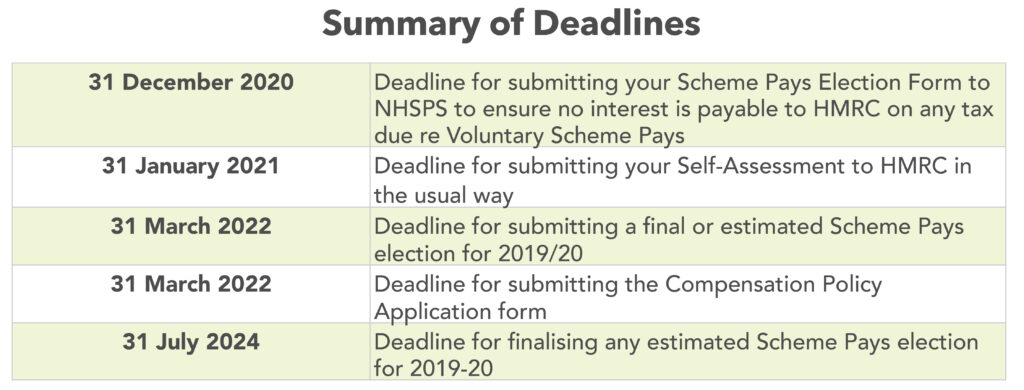

This is a separate process to the NHS Pension Scheme Pays Election. You must complete the Scheme Pays Election Form (SPE2) for the 2019/20 year by the 31st March 2022 deadline (extended recently from 31st July 2021) before submitting the compensation form.

If you are making an election based on an estimate of your annual allowance charge, they have suggested entering a minimum of £10. However, if interest is due to HMRC at a later date you might want to base your election on a higher figure so this is minimised.

Once submitted, you can complete the England Compensation Form or Wales Compensation Form if applicable, and these have a deadline of 31st March 2022.

Retired members can also apply as long as they have used scheme pays for the 2019/20 year

2. Retiring from the NHS pension 2015 section

There is a delay in processing retirement application forms for the 2015 section as many are stating the reason for retirement as “age”. This should only be a reason if you have reached your state retirement age or 65, if that is later.

3. How to get your information/forms to the NHSPS

To prevent delays, most forms including Scheme Pays Election can be sent via email to NHS pension scanning at: nhsbsa.pensionscanquery@nhs.net. Exceptions to this include the 2019/20 Compensation Policy Application Form and Coronavirus Lump Sum Payment which must be sent as hard copies.

For pension queries, the email address is now: nhsbsa.pensionsemployers@nhsbsa.nhs.uk

4. The McCloud Consultation – age discrimination

The consultation is now closed, and key points are as follows:

- The government chose the Deferred Choice Underpin (DCU) option to give members a clear and informed choice at retirement of the benefit entitlement.

- Members who have already retired will be given the choice retrospectively.

- From 01 April 2022 the legacy 1995/2008 schemes will be closed with all members retaining membership on these schemes up to this date, and with all benefits after this date being in the 2015 section.

- Members with tapered protection will be offered a choice of which scheme they want between 01 April 2015 and 01 April 2022.

It is a massive exercise, and should include those who have applied for lifetime allowance protection, stopped added years, or left the scheme due to tax concerns.

The processes for addressing issues like this, we are assured, are all in hand, and the government expects to have the processes implemented by 01 October 2023. There will be updates from the NHS between now and this date.

5. NHS pension contribution rates

A member’s tiered contribution rates remain unchanged and extended to 31st March 2022.

The NHSPS never sits still. Things are always evolving. Managing the change and learning how it applies to you is tricky. That’s why we are here – Contact us for specialist, independent financial advice if any of these issues could be relevant to you.

Do you need more clarification? Let us know by adding a comment below.